Bank Recovery and Resolution Directive (BRRD)

Please note that this publication only serves to provide general regulatory background information. This publication is not necessarily complete or correct, and it does not contain individual, legal or other advice. We urge our counterparties to familiarise themselves with the EU Bank Recovery and Resolution Directive (hereinafter referred to as “BRRD” or “the Directive”) and to obtain the necessary information, as this European Directive might have impact on the terms of our agreement(s).

Introduction to BRRD

After the financial crisis, the EU carried out a number of measures to harmonise and improve the tools for dealing with bank crises in its Member States. Amongst others, this resulted in the introduction of the BRRD, which was adopted in June 2014 with a national implementation deadline of January 2015. In addition, as part of the European Banking Union, the Single Resolution Mechanism Regulation (SRMR) was introduced. The SRM applies to banks covered by the single supervisory mechanism. It is the second pillar of the banking union. Hereafter we will collectively refer to the BRRD and, where applicable, the SRMR, as BRRD. The BRRD and SRMR were updated (‘amended’) in 2019 (BRRD II and SRMR II).

The BRRD aims to harmonise Member States’ resolution frameworks and therefore it significantly expands the scope of regulators' powers for dealing with failing banks and investment firms. The BRRD has a direct statutory (overriding) effect on contracts governed by the laws of where the BRRD has been implemented, i.e. a Member States of the EU and the wider European Economic Area (EEA).

The Directive requires banks to prepare recovery plans to overcome financial distress. Should this fail, the resolution framework laid down in the BRRD entrusts the resolution authorities with a set of tools and powers to intervene swiftly and at a sufficiently early stage in a non-viable entity, in order to ensure the continuity of the entity’s critical functions, while minimising the impact of its potential failure on the economy and the financial system.

The BRRD provides authorities with:

The Directive also contains requirements for bound banks and investment firms in EEA Member States to include certain clauses into in-scope financial contracts governed by non-EEA law. The goal is to ensure that these financial contracts in the EEA banking sector which are governed by non-EEA law can be subjected to the resolution measures in the same way as contracts governed by the laws of an EEA Member State.

Why is the BRRD important?

The BRRD sets common rules for when and how authorities will intervene to support troubled banks. It foresees a phased approach to supporting such banks, encompassing precautionary, early intervention and measures designed to prevent bank failures. Where failure is unavoidable, the BRRD aimsto ensure orderly resolutions, even for banks operating across national borders. Along with the revisions to the DGS Directive, this further harmonises the approach to protecting retail depositors in the EU.

It clearly establishes the principle that private investors in banks must pick up the first costs for banks’ poor risk management, before EU/EEA Member States and their taxpayers are called on for financial support. By doing so, it directly addresses the question of moral hazard, through increasing market discipline over banks’ activities and limiting the risks they take on. The BRRD still leaves open the possibility of temporary public intervention to respond to systemic threats to the banking and financial markets more widely, but on a very limited basis.

Which Rabobank counterparties will be affected by the BRRD?

All our branches and counterparties located in the European Economic Area (EEA) are (directly) bound by the BRRD, as well as our non-EU/non-EEA counterparties who receive/with whom we exchange products and/or services governed by the laws of an EU Member State. In addition, requirements are laid down in the BRRD for institutions in the EU banking sector to include certain clauses into their in-scope financial contracts governed by non-EEA law, which affects our counterparties from outside the European Economic Area too when it comes to contracts governed by non-EEA law.

The BRRD applies to the following entities (and thus also to counterparties who have in-scope financial contracts with these entities under both EEA and non-EEA law):

Required implementation following Article 55 BRRD & Article 71a BRRD into contracts governed by non-EEA law

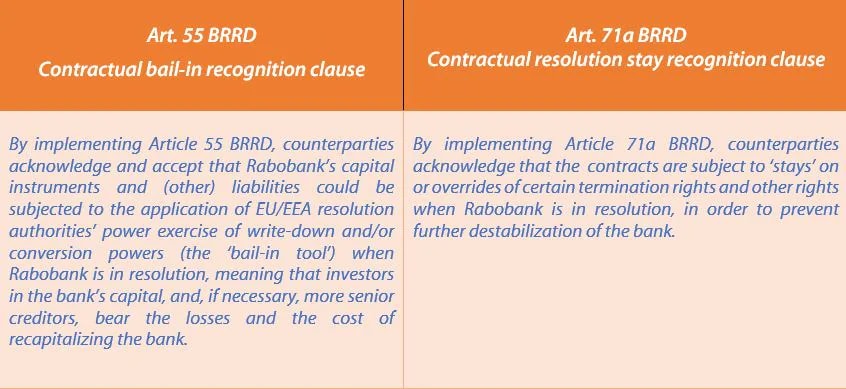

As stated above, the BRRD requires the bound entities from Member States – and therefore Rabobank – to include certain clauses into their in-scope financial contracts governed by non-EEA law. Specifically, this sees to the contractual ‘bail-in recognition’ (art. 55 BRRD) and ‘resolution stay recognition’ (art. 71a BRRD) clauses.

How does this impact the counterparties of Rabobank?

Rabobank needs to implement both the contractual requirements of Article 55 and Article 71a BRRD into its in-scope financial contracts with counterparties. After implementation, these clauses apply to the amended contracts. Below you can find a more detailed explanation of the contractual recognition of the ‘bail-in’ and ‘resolution stay’.

Contractual bail-in recognition requirement – Article 55 BRRD

Article 55 of BRRD requires banks and certain other financial institutions established in EU/EEA Member States to include contractual terms in agreements governed by non-EEA law to specify that those liabilities under such agreements may be subjected to ‘bail-in’ under BRRD. The rationale is to ensure counterparties contracting under third country law, acknowledge and agree that bail-in powers could be applied to a given contracts. ‘Bail-in’ refers to powers exercisable by resolution authorities in EU/EEA Member States to resolve troubled EU banks by writing down and/or converting bank capital and other instruments in order to absorb losses and, to the extent necessary, recapitalize the bank. This is one of the resolution tools resolution authorities can use to ensure the a bank that provides critical functions and which cannot be wound down via ordinary insolvency proceeding can be resolved in an orderly manner, while minimizing the impact on the economy and financial system. The bail-in mechanism makes sure that losses and recapitalization costs of a failing entity are borne by the equity investors (e.g. shareholders) and creditors of the entity. It should be noted that the bail-in tool follows the creditor hierarchy (i.e. more junior ranking instruments are to be bailed-in prior to more senior claims and only to the extent necessary, and furthermore an important safeguarding principle in the BRRD is that investors and other creditors should not be worse-off in resolution than they would have been had the bank been liquidated via insolvency proceeded (the “no creditor worse off” or “NCWO” principle).

For financial contracts such as derivatives, the ISDA 2016 Bail-in Art. 55 BRRD Protocol (Dutch/French/German/Irish/Italian/Luxembourg/Spanish/UK entity-in-resolution) aims to assist entities to comply with the requirement. Its implementation results in the contractual recognition of the EEA resolution authorities’ bail-in powers under the BRRD, as required by Article 55.

Contractual resolution stay recognition requirement – Article 71a BRRD

Article 71a BRRD entails an obligation which requires in-scope entities (banks and certain subsidiaries) to incorporate a clause into certain contracts, governed by non-EEA law, through which parties acknowledge certain temporary ‘stay powers’ of EEA resolution authorities and/or accept certain limitations to their termination rights. The contractual recognition of ‘resolution stay’ and the EU resolution authorities’ temporary resolution stay powers seeks to give effect to ‘stays’ on contractual rights. This overrides certain contractual terms, such as termination rights, in order to prevent triggering terms that could further destabilize the entity in resolution.

The article concerns both contractual recognition requirements for ‘active’ resolution stay powers and ‘passive’ (automatic) stay. The latter is not a resolution power, but more of a statutory and/or contractual overriding arrangement that essentially restricts and overrides any existing (contractual) termination rights that parties could otherwise potentially exercise merely as a result of a resolution event of Rabobank or other Rabobank Group entities. The purpose of the passive stay is to ensure the bank’s and its subsidiaries’ continuity during and post-resolution.

For financial contracts such as derivatives, the BRRD II Omnibus Jurisdictional Module to the ISDA Resolution Stay Jurisdictional Modular Protocol enables entities to amend the terms of in-scope contracts by obtaining from certain counterparties a contractual recognition of the application of stays on termination with respect to requirements of Article 71a BRRD. The EU Stay Law Annex attached to the ISDA BRRD II Omnibus Jurisdictional Module contains references to the relevant national implementation legislation and stay powers of certain jurisdictions that have transposed Article 71a BRRD.

How will Rabobank arrange for this required implementation?

The BRRD is a key component of European efforts to ensure that the EU/EEA effectively addresses the risks posed by the banking system. Likewise, Rabobank aims to implement the BRRD requirements in an effective way to achieve compliance with the Directive to the best of its abilities.

In order to become compliant with the requirements, we kindly request our in-scope counterparties to, where relevant, adhere to the two aforementioned ISDA protocols (the ISDA 2016 BRRD Bail-in Protocol and the ISDA BRRD II Omnibus Jurisdictional Module). Adherence to these ISDA protocols ensures an efficient and uniform way to amend the terms of the relevant financial contracts (without the need for separate amendment agreements). When counterparties adhere to the protocols, the required contractual ‘bail-in recognition’ and ‘resolution stay recognition’ will automatically be included in the relevant financial contract.

More information on the links below: