Update

Despite falling house prices, housing affordability remains an issue

Increased interest rates have worsened housing affordability. As a result, house prices are expected to fall by 3.0% in 2023 and 1.5% in 2024.

Summary

House prices fall for first time in almost a decade

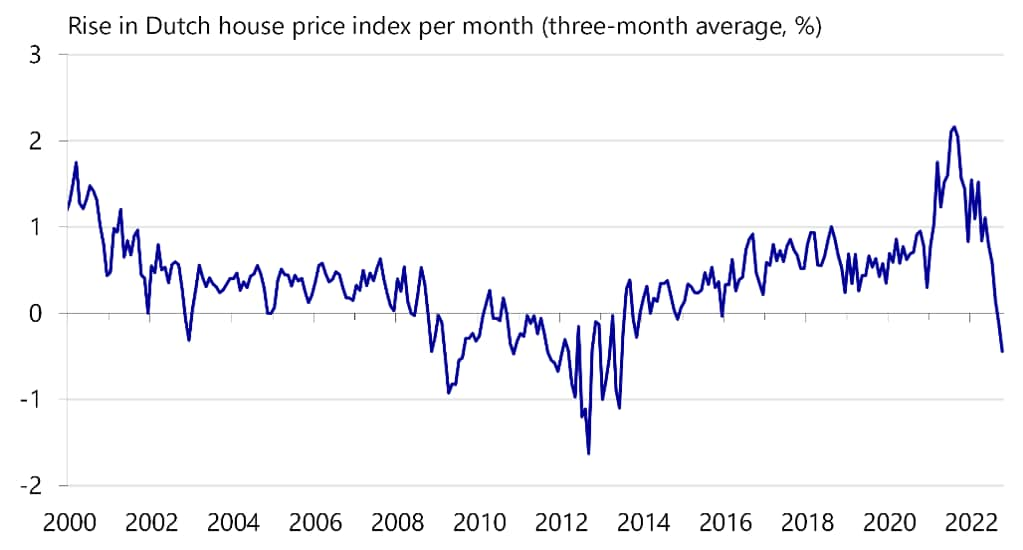

In October, house prices fell for the third month in a row compared to the previous month. However, existing homes for sale were still 7.8% more expensive in October than in the same month a year ago, mostly due to strong price increases earlier this year. The decline in house prices is largely related to increased mortgage interest rates. This has decreased buyers’ borrowing power, so that at today’s high prices, there is less demand for owner-occupied homes. As a result, fewer houses are being sold, the number of homes on the market is increasing (see section “More ‘for sale’ signs and fewer homes sold”), and house prices have begun to fall (see Figure 1).

Figure 1: House prices are falling

Many prospective buyers are now priced out of the housing market

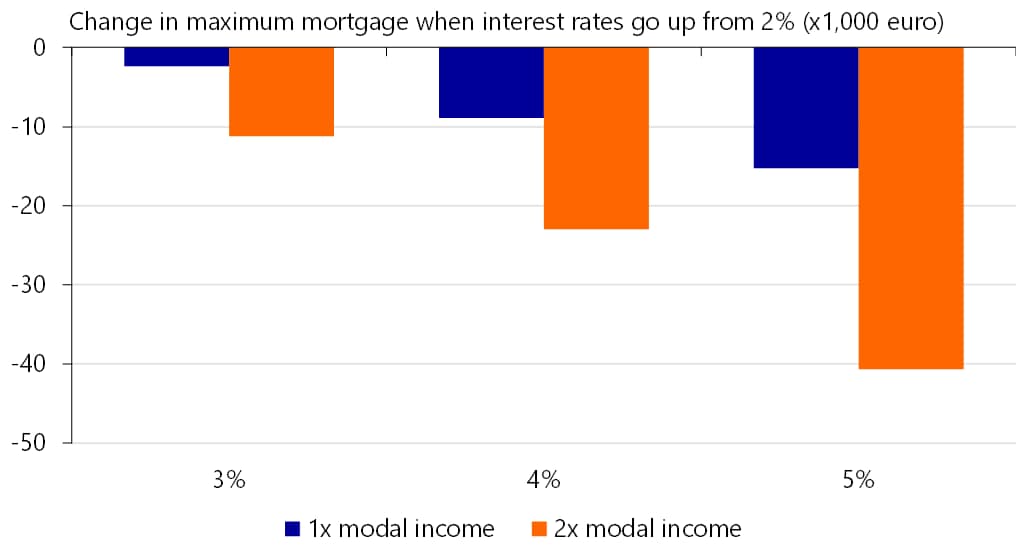

Despite small reductions in recent weeks, mortgage rates have risen sharply in a relatively short period of time (see Figure 2). Meanwhile, the average mortgage interest rate for new mortgage applications is already much higher than shown in the figure, because the DNB figures shown chart the moment of notarizing the deeds. Higher interest rates mean that people can borrow substantially less for a house relative to their income (see Figure 3). Therefore, they can also make lower bids. But despite having a potentially smaller mortgage, these buyers would have to spend more each month. As a result, a large portion of the housing supply for sale is inaccessible to the average buyer.

Higher mortgage interest rates depress demand and, in turn, house prices. Rapid changes in mortgage rates tend to affect house price trends more quickly (Dutch only) (and more strongly) than a gradual increase in mortgage rates over a longer period of time.

Figure 2: Mortgage rates rising rapidly

Figure 3: Higher interest rates cause borrowers to borrow tens of thousands of euros less

Not only do new mortgages cost substantially more, other prices (Dutch only) have also risen sharply in the past year. Groceries have become more expensive and monthly energy bills are much higher than last year. Other products and services have also become more expensive recently. Substantial price increases across the board in the consumer basket leave less for would-be buyers to spend on housing. This is likely to lead to additional falls in demand.

Deteriorated sentiment

The dwindling confidence in the housing market is also likely depressing demand for houses. Meanwhile, the Eigen Huis Marktindicator (Dutch only) stands at 75, indicating that more people have negative sentiments about the current housing market conditions than positive ones (a value of 100 represents a neutral mood). The market indicator has not been this low since September 2013. Back then, the market was recovering after a long period of house price declines.

The buying intention index from housing website Funda’s monthly barometer (Dutch only) fell from 88.1 to 80.4 over the past year. This index concerns potential buyers’ intention to buy a house in the next three months. The decreased buying intention is also well reflected in the number of house viewings. According to NVM, the number of viewings (Dutch only) per house has fallen sharply: from ten viewings per house at the beginning of the year to five in July. Makelaarsland (Dutch only) outlines a similar decline, although the drop in the number of viewings seems to have leveled off somewhat recently.

House price decline to continue in coming years

House prices will be down 6.6% by the end of 2024

Influenced by increased capital market interest rates, the weakening economy, and slightly rising unemployment, we expect the current housing price decline to continue in the coming years. This year, existing owner-occupied homes are still 13.7% more expensive than in 2021, mainly due to the strong growth in house prices at the end of last year and the beginning of this year. But for 2023, we expect an average house price decline of 3.0%, followed by another 1.5% decline in 2024. By the end of 2024, existing owner-occupied homes for sale are expected to be 6.6% cheaper than in the third quarter of 2022. Home buyers will then pay about the same amount for an existing owner-occupied home as they did at the end of 2021 (see Figure 4).

Compared to our November house price estimate – an interim update to our previous Housing Market Quarterly – our estimate this time around is virtually unchanged. However, the house price decline expected for 2024 has lessened slightly, from a 2.0% decline to a 1.5% decline. This adjustment is based on the updated macroeconomic outlook.

Figure 4: Average 2021 price level not yet in sight

Capital market interest rate developments determine pace of house price decline

If the past year has taught us one thing, it is that capital market interest rates can rise very quickly under the influence of vicious inflation (and inflation expectations). Ten-year interest rate expectations play an important role in our house price estimates because they provide an indication of mortgage rates. In recent years, new mortgage rates have been about 1.0 to 1.5 percentage points higher than swap rates.

In the event of unforeseen (rapid and large) changes in capital market interest rates, our house price estimates quickly become outdated. Therefore, in Figure 5 we outline the range of impact higher or lower capital market interest rates can have on house price developments. In our base case, we assume that ten-year interest rates peak at 3.0% in Q1 2023 before gradually declining to 2.4% in Q4 2024. In the lower interest rate scenario, the swap rate in 2024 is one percentage point lower than in the base case, and in the higher interest rate scenario, it is just 1 percentage point higher. The purpose of the scenarios is not to identify the most plausible alternative scenarios, but purely to show the effect interest rate trends have on the housing market.

House prices fall in all the scenarios considered (see Figure 5). However, in the scenario with lower interest rates, the price decline is limited to 4.7% compared to Q3 2022 (versus -6.6% in the base case). This scenario could occur, for example, if inflation expectations fall faster than we assume in the base case – due to a sudden peace agreement between Russia and Ukraine, for example – and the European Central Bank raises policy rates less than we currently assume.

Conversely, a 1-percentage-point-higher capital market interest rate results in a firmer house price decline. In that case, existing owner-occupied homes for sale will be about 8.4% cheaper by the end of 2024 than they were in the Q3 of this year. This situation could arise if high inflation is harder to control than expected.

Figure 5: Price trends depending on interest rate movements

Regional house price development

Zooming in on the provinces, we see that existing owner-occupied houses in Q3 were considerably more expensive everywhere compared to a year ago, ranging from 13.5% in Flevoland to 9.6% in Limburg. But across the board, house price growth fell sharply (see Figure 6). Some provinces – including frontrunners Flevoland, Utrecht, and Limburg – also saw house prices fall slightly from April through June (see Figure 7). Only in South Holland and Gelderland did house price growth quarter-on-quarter slightly exceed 1%. This is a substantially different picture from the quarter-on-quarter growth we saw in Q3, when price increases between provinces ranged from 1.6% (Friesland) to 4.5% (Overijssel). Of the four major cities, Utrecht in particular saw a relatively sharp decline in house prices, while The Hague saw relatively strong growth. This diverse picture is difficult to explain.

Figure 6: House price growth flattens everywhere

Figure 7: In some provinces, house prices were already falling over the summer

Regional house price forecast

Despite the cooling housing market, all regions are still expected to achieve a double-digit growth rate this year (see Figure 8). In line with the national picture, regionally, this high annual figure is the result of price increases that have been in place for some time. We foresee the strongest house price growth for the Veluwe region. Existing owner-occupied houses there are expected to be more than 16% more expensive in 2022 than in 2021. Flevoland is also seeing a very solid increase in house prices at an average of 16%, even though the region’s robust growth over the past few quarters has now turned into a slight decline. Existing owner-occupied houses saw the lowest price increase in the south of Limburg. There, average house price growth this year is expected to be about 11%.

The picture for 2023 is very different. House prices are falling in almost all regions, in line with the national forecast (see Figure 9). We foresee the steepest decline for the Amsterdam region and regions surrounding Amsterdam: Haarlem, Zaanstreek, and IJmond. Existing owner-occupied houses here will be about 4% cheaper in 2023 than in 2022. In 2023, existing houses for sale in the two Zeeland regions are expected to be about as expensive as in 2022. As we wrote earlier, house price growth in those regions may last a bit longer (or fall back more slowly) because the price recovery there started a bit later than in other parts of the country, after the 2008-2013 housing market crisis.

Figure 8: 2022 house prices higher than last year in all regions

Figure 9: House prices to decline next year, especially in the west of the Netherlands

More 'for sale' signs and fewer sales

In the wake of declining confidence in the housing market, the sales strategy of homeowners looking to sell their homes (Dutch only) is shifting. Instead of buying first and then selling, more homeowners are now looking to sell first and then (with more certainty about the sale proceeds) buy another home. Regardless of the changed strategy, it seems that people have pushed forward putting their homes on the market out of concern that it will soon take longer to sell their home (at the desired price). The result is that there are more houses for sale (see Figure 10). However, the supply of houses does seem to be increasing less rapidly lately.

According to figures from the NVM (Dutch only), houses that have been put up for sale are also on the market for longer. The average duration of supply (the number of days that have elapsed since the average house that has not yet been sold was put up for sale) was 48 days in Q3, half a month longer than in Q2. This broke the trend of ever-decreasing maturity for the first time since the start of 2020. The average time for selling a home (referring to homes that did sell) is also rising slightly, albeit less sharply than the average number of days that all homes offered for sale spend on the market. This may indicate that houses listed relatively recently are still selling quickly, while other houses – for example, more expensive houses, houses that are less well maintained, or those with a worse energy label – remain on the market longer. In that situation, marketable houses tend to make up a larger share of houses that did sell (which determines the average time to sell a house), while less marketable houses, on the other hand, account for an increasing share of houses that have not yet sold.

Figure 10: There are more houses to choose from

Fewer homes sold, but the decline does flatten off

As it has become more difficult to sell houses, the number of sales of existing owner-occupied homes is declining (see Figure 11). This decline began even before the rise of inflation and capital market interest rates. Initially, the decline in sales was primarily related to the lack of supply of existing owner-occupied homes, but now declining demand seems to be the cause. In the past 12 months, as much as 17% fewer existing owner-occupied homes have been sold than in the same period the year before. Also, in the last few months, despite there being more houses on the market, there have been substantially fewer sales than in the same months last year.

Figure 11: Decline in sales slows down

Regionally, the decline in the number of sales last year was especially large in Noord-Brabant and Drenthe. In these provinces, 22% fewer houses were sold in the last four quarters than in the same quarters a year earlier (see Figure 12). In Flevoland, the number of transactions remained most stable with a 13% decline. The big cities show a diverse picture. In Amsterdam, the number of sales fell by 19%, slightly more than the average in the Netherlands. In Rotterdam, which saw a 9% drop, the number of transactions fell by much less than the average.

Figure 12: Strongest sales decline in Drenthe and Noord-Brabant

Home sales continue to decline in coming years

The first sign of a cooling housing market is usually a drop in the number of sales. Going forward, we expect this number to continue to fall, but significantly less sharply than would have been the case in the past with an equal drop in demand. For example, the cooling housing market after the start of the financial crisis in 2008 was accompanied by a near 50% reduction in the number of transactions.

In the two years before the 2022 peak, house prices rose by as much as 33% (up from 7.5% before the 2008 peak). Therefore, we expect that even with falling house prices, most homeowners will remain ‘above water’ with their mortgages and will typically still be able to make a substantial profit when they sell. Also, home buyers today almost always have full amortization mortgages rather than interest-only mortgages, which were common in the 1990s and 2000s. Moreover, on average, they start with a lower mortgage relative to the home value, as the maximum mortgage was gradually reduced to 100% of the home value between 2013 and 2018. Because homeowners have more home equity, we expect that they are more likely to follow through on their own plans to move and are also more willing to accept a lower offer on their current home. We therefore expect house prices to adjust more quickly to changed market conditions, while the number of transactions remains more level.

We anticipate 188,000 existing owner-occupied homes changing hands this year. That’s 38,000 fewer than last year. For 2023 we expect a further decline in the number of sales, to a low of 179,000 transactions, and for 2024 a slight recovery to 184,000 homes sold (see Figure 13). This recovery is based on the expectation that capital market interest rates will have declined somewhat by then, which – combined with lowered house prices – will also lead to some recovery in demand for owner-occupied homes. Like our estimate of house prices, our forecast of the number of transactions is highly dependent on how interest rates and economic conditions will actually develop.

Figure 13: Number of sales declines

Decline in house prices inhibits new construction

We assume that a decline in new construction will also depress the number of sales of existing owner-occupied homes in the coming years. The number of building permits issued has been declining for some time, and the number of new construction owner-occupied homes sold has also been falling recently (see Figure 14). Because existing homeowners buy a sizable portion of new construction, that also means fewer homeowners will put their homes up for sale in order to move to a newly built home.

Our expectations for new construction projects are not high for several reasons, the biggest being that residential construction is one of the most cyclical sectors and is also very sensitive to the development of capital market interest rates. Factors such as rising construction costs, labor shortages, and the nitrogen crisis are also problems for the construction sector. We anticipate a 5.5% decline in housing investment – in new construction, remodeling, and renovation of homes – in 2023 and another 4.5% in 2024. Last month, the provinces and the housing minister agreed to build more than 917,000 homes through 2030. However this is unlikely to succeed because the policy package is almost certainly not enough to solve bottlenecks in the availability of building sites, declining margins, and construction labor shortages.

Figure 14: Fewer and fewer new construction homes sold

Featured: Is there light at the end of the tunnel for aspiring first-time buyers?

In recent years, it has become increasingly difficult (Dutch only) for young, aspiring first-time buyers to buy a home. This is because the average starter home has increased in price much faster than what many first-time buyers can afford. Because the affordability of owner-occupied homes has deteriorated, young adults are less likely to own a home than they were a few years ago.

Problems surrounding the affordability of owner-occupied homes affect all first-time buyers, young and old. For anyone who cannot rely on equity, but depends primarily on income (for a mortgage), the hurdle of buying a first home is increasingly difficult to overcome. In recent years, although the maximum mortgage for buyers with two modal yearly incomes has risen, house prices rose much harder. Meanwhile, even two modal yearly incomes are insufficient to buy an average-priced home, taking into account income-loan norms and mortgage interest rates at a ten-year fixed rate (see Figure 15).

Figure 15: Average home sold now also out of reach of buyers with two modal incomes

A frequently asked question is whether potential first-time buyers will soon have more chances to buy a home now that house prices are falling somewhat and this decline is expected to continue. Based on individual house transactions from Kadaster (Land Registry) and general house price trends, the average starter home cost around EUR 383,000 (Dutch only) in Q3 2022. (The average starter home takes into account the characteristics and location of houses bought by first-time buyers in recent decades). Considering the expected house price increase, the same starter home will cost over EUR 357,000 by the end of 2024 – about EUR 25,000 lower than in Q3 this year.

Figure 16 shows an estimate of the trend in monthly net mortgage payments for the average starter home over the next two years. This estimate is based on our expectations about the development of house prices and interest rates, and the tax treatment of owner-occupied housing. Because both house prices and monthly costs depend heavily on the development of interest rates, we have also calculated the monthly costs corresponding to our scenarios with 1 percentage point higher and lower swap interest rates. If these rates are higher or lower, the price of an average home will fall slightly more or less than in our baseline scenario.

Despite falling house prices, higher interest rates mean that, on the whole, first-time buyers will be no better off in the near future than in Q3 2022 (see Figure 16). In the baseline scenario, the monthly costs of the average starter home – already considerably reduced in price by then – do not fall below the level of Q3 2022 until the end of 2023. Especially in the lower-interest scenario, first-time buyers are clearly better off in terms of net monthly costs in 2024. Net monthly costs continue to rise for a longer period in the higher-interest scenario, despite the fact that house prices are expected to fall somewhat faster (see also Figure 5). The explanation is that house prices react to interest rate changes with a delay. Especially in the higher interest rate scenario, where capital market interest rates continue to rise in 2023, house prices continue to fall beyond 2024. While home buyers experience the disadvantages of rising interest rates immediately, they do not benefit from lower house prices until later.

Figure 16: In the short term, high interest rates mainly disadvantage first-time buyers