Research

Spain is not Italy!

Unlike in Italy, Spain’s new government is very much pro-EU and has indicated to comply with the European budget rules. The economic impact of the government shuffle will expectedly be very limited in the short term. Early elections are likely.

Summary

Adíos Rajoy

Last Friday, Spanish PM Mariano Rajoy was ousted in a no-confidence vote in parliament, after a series of corruption convictions for senior staff members of Rajoy’s Partido Popular (PP). He was replaced by socialist (PSOE) leader Sanchez, who had initiated the motion and gathered support from as much as eight parties, including the far-left populist Podemos and two Catalan separatist parties. Sanchez now heads a centre-left minority government and is Spain’s first PM without having won an election. Sanchez has indicated earlier that he will lead the country to fresh elections, without giving a timeframe though. But even if he intends to head the government until the scheduled elections in mid-2020, early elections seem likely due to his very weak mandate.

Nevertheless, Sanchez has put some thought in who to give the minister posts. The list he has presented so far includes the previous finance minister of Andalusia, who has a track record of fiscal prudence in the region, a former head of the European Parliament as foreign minister, and the current director general of the European Commission budget department as economy minister. With this list Sanchez wants to make clear to the markets and Brussels that his government is very much pro-EU and should not be feared, hence that Spain is not the next Italy!

Figure 1: A wide range of parties voted in favour of ousting Rajoy

Figure 2: Spaniards are very much in favour of the euro

Weak mandate, limited changes

The Socialist party only holds about a quarter of total seats in the lower house, implying that Spain’s incoming government has an even weaker mandate than the previous Rajoy government. Given that the ousted government with around one third of total seats was already close to being incapable of implementing bold measures, we surely should not expect many policy changes, for better or worse, over the next few months.

Prior to the no-confidence vote, Mr. Sanchez had also already committed himself to implementing the 2018 budget of his predecessor; including, higher minimum pensions, higher wages for civil servants and income tax cuts. The budget does not seem to tackle Spain’s still large structural budget deficit, but would be in line with Europe’s 3% budget deficit rule. The only caveat here is that the budget so far has only been approved in the lower house and still needs to pass in the Senate. And in the Senate Rajoy’s PP has an ample majority. Accordingly, it is actually up to the senators of the ousted PP whether Spain will have a 2018 budget any time soon. It is likely they will at least ask for some adjustments, but without preventing the budget can pass. The reasoning here is that any inability by the incoming government to pass the budget could cause early elections for which the PP is clearly not ready.

Looking forward, while major policy changes are unlikely under the current government, some fiscal slippage should be expected. Mr Sanchez's government also depends upon support from the far-left populist Podemos and above all is eager to win back voters on the left. Furthermore, limited risks remain that previous (labour market and pension) reforms will be partly reversed or adjusted amid support for such moves among both Podemos and his own party. Still, given Spain’s strong growth outlook and overall very pro-EU parliament, we do not fear major fiscal upheaval. And, should it prove necessary, we think Spain would be able to implement ad hoc cost saving measures if the European Commission requires it to do so, even though it could cause the socialist government to fall.

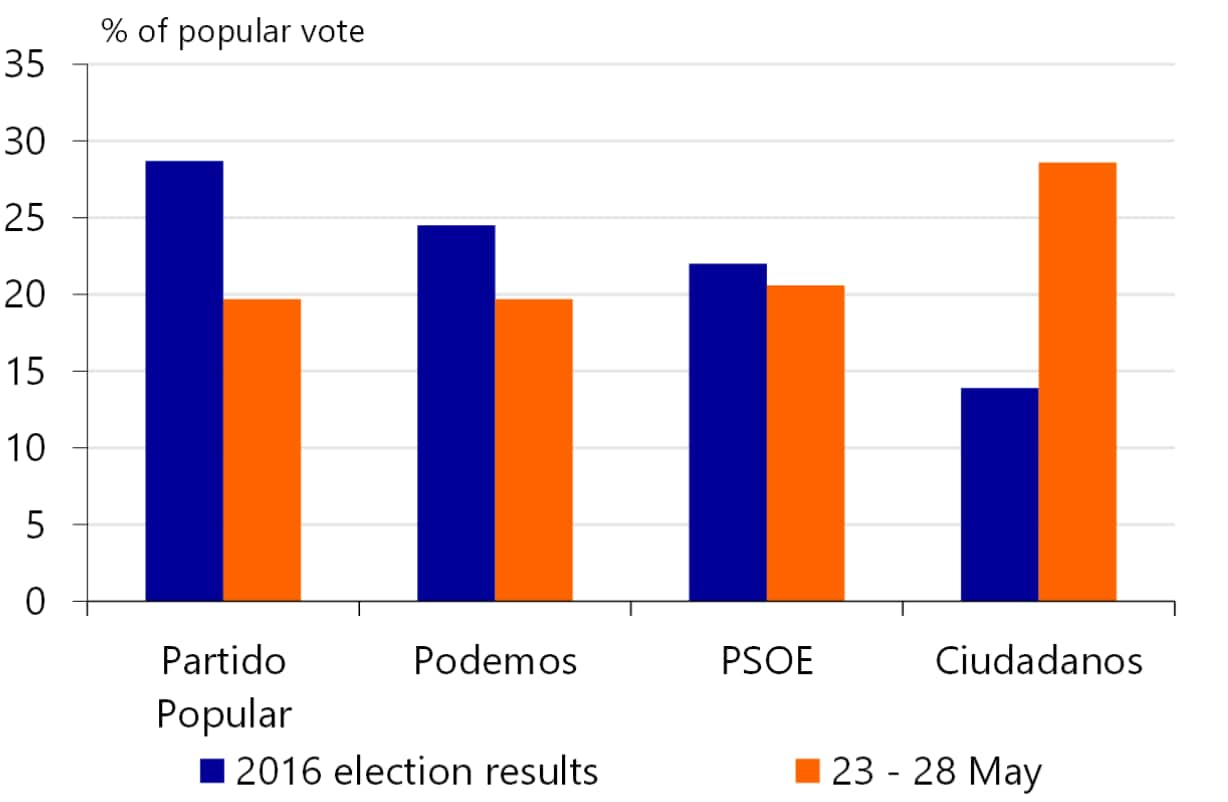

Figure 3: Ciudadanos lonely at the top

Figure 4: Spain's economy is on fire

Stand-off with Catalonia to continue

Under a PSOE government, dialogue between the Catalan and the central government might improve somewhat. In return for the support of the Catalan separatists in the no-confidence vote, Sanchez has at least promised to hear them out. Yet while tensions are unlikely to reach the highs we saw in the final months of 2017, they are here to stay for a long time as the PSOE is opposed to an independence vote, while the ultimate goal of the Catalan government is indeed an independence referendum. Note that direct rule over the region from Madrid has recently been lifted following the installation of a new Catalan government, but the central government still controls the region’s finances.

Economic recovery to continue

At this moment, we expect that recent developments will not impact Spain’s short term economic outlook. We think the economy will keep posting strong figures. Yet we do expect economic growth to slow from 3.1 percent in 2017 to 2.8 percent in 2018 and 2.2 percent in 2019. Consumption growth is set to slow mainly due to moderating pent-up demand and lower employment growth. At the same time, historically low household saving rates suggest that households might be less induced to use their remaining savings for consumption than last year. We also expect investment growth to slow down slightly on the back of lower export growth, less pent-up demand in most sectors except for construction, and a smaller boost from low financing costs.

Should we fear new elections?

As mentioned, early elections are likely. Either because Sanchez willingly steps down for the democratic good, like the centre-party Ciudadanos has asked for, or because the government collapses on the back of its very weak mandate. The latter is very likely to happen when talks about the 2019 budget intensify. Unlike the 2018 budget, it will prove very difficult in our view for the PSOE government to manage to get a 2019 budget approved in parliament. This could trigger early elections as soon as early 2019. While this might cause some political instability and uncertainty, the Spanish economy has been able to cope with that uncertainty before. Moreover, a change of government could in the end prove to be better for Spain. The current government’s very weak mandate imply that it has limited ability to implement the policies necessary to foster Spain’s long term growth potential.

At this point Ciudadanos is leading the polls, while the other three large parties (PSOE, PP, Podemos) seem to be fighting over becoming the second place. It is difficult to predict if Ciudadanos can maintain its leading position over the next months. First, because the PSOE and also the PP are actually likely to regain some ground. The PSOE could regain some support from voters in the centre and on the left if the economy keeps going strong and if it can increase spending and minimum wages somewhat as intended. Meanwhile the PP could recover some far right votes, as in the opposition it will be easier to play take a hard stance regarding the Catalan separatist movement. In fact, the most important reason for why Ciudadanos has gained so much support lately is because of its very tough line against the Catalan separatist government over the past few months.

Furthermore, due to Spain’s regional proportional election system it is difficult to translate popular vote polling into seat distribution. Still, if Ciudadanos were to become the largest party this could be benefit Spain’s economy. In the previous elections their policy agenda included measures and reforms that should benefit Spain’s growth potential. Obviously at this point it is very difficult to tell if they could form a majority government, if they could prove they can transform good ideas into good policy. After all, parliament for sure will be fragmented again, making implementation difficult. But it seems that fresh elections could in fact support Spain’s long-term economic outlook.

The upshot is that given the new government's pro-European stance, recent developments in Spain are unlikely to trigger similar market reactions as recent events in Italy. Even in the case of early elections, risks to the economy and public finances are limited. Still, the absence of a parliamentary majority for Spain's new government and uncertainty around what would happen after such elections could bring with it some risks, particularly so if the current solid economic growth pace were to slow markedly.