Research

Q&A on the new Pan-European Pension Product

A Q&A on the Pan-European Pension Product (PEPP), a new voluntary personal pension product that will be offered in the EU from 2023.

Summary

What is a Pan-European Pension Product?

A Pan European Pension Product (PEPP) is a voluntary personal pension scheme that offers consumers a new pan-European option to save for retirement. The new product will be complementary to existing pension products and plans and will not replace them. The product provides the possibility to transfer the accrued capital between providers within and across European borders. The European Commission recommends the individual member states to treat the product in a fiscally friendly way like similar national pension products, even though it is not an obligation.

When will we see the first PEPP?

We will likely not see the first PEPP before 2022 or even 2023 as it will simply take time before the regulations are made. The new Regulation itself will soon be published in the Official Journal of the European Union. However, the details have still to be worked out, and in the coming year the Commission will work with EIOPA on the technical standards and on a number of delegated and implementing acts. This Regulation will only go live 12 months after the official publication of technical standards and acts. The EC expects a timeframe of approximately 2.5 years.

Who is in charge of providing access to the market?

As expected both the local and the EU regulator play a role. EIOPA will manage a register of the PEPPs that have been registered and could be provided and distributed in the Union, as well as the PEPP providers and a list of Member states in which the PEPP is offered.

The provider should put in a request for registration at the (local) competent authority. The local authority will evaluate the request and if they approve, they should notify EIOPA.[1] The competent authority has three months to check whether the applicant is allowed to provide a PEPP and if its documents and information comply with the Regulation. The competent authority can prohibit or restrict the distribution of a PEPP in the member state.

EIOPA does have the power to issue a temporary ban of the marketing, distribution or sale of a PEPP within the EU if there is a significant consumer protection concern or a threat to the integrity or stability of the financial markets. EIOPA is to coordinate the supervision in order to guarantee the consistent supervision over the different member states.

[1] Any subsequent changes to the information and documents provided in the registration procedure should be immediately notified to the competent authorities and to EIOPA.

Who can offer a PEPP?

The PEPP could be offered by a broad range of financial providers such as insurance companies, asset managers, banks and certain occupational pension funds. This will further open the market for pensions in Europe to asset managers directly, which up till now has been dominated by insurers and pension funds.

Only Institutions for Occupational Retirement Provision (IORPs) who are authorised and supervised to provide personal pension products are allowed to provide a PEPP. Currently, Dutch pension funds are not allowed personal pension product which means they will (likely) not be allowed to provide a PEPP. For other IORPs that can provide a PEPP, all assets and liabilities corresponding to the PEPP should ring-fenced without the possibility to transfer them to other retirement businesses.

A provider can offer a PEPP that they have designed, but they can also offer PEPPs of other parties which would make them distributors. If for example company X offers its PEPP in country A, B and C, it can also offer a PEPP product of another provider in country D and E as long as these are in compliance with the relevant law.

The coverage of biometric risks, such as disability, can only be done by an (re)insurer. This means other providers need to cooperate with an (re)insurer if they want to provide this coverage.

What does a PEPP look like?

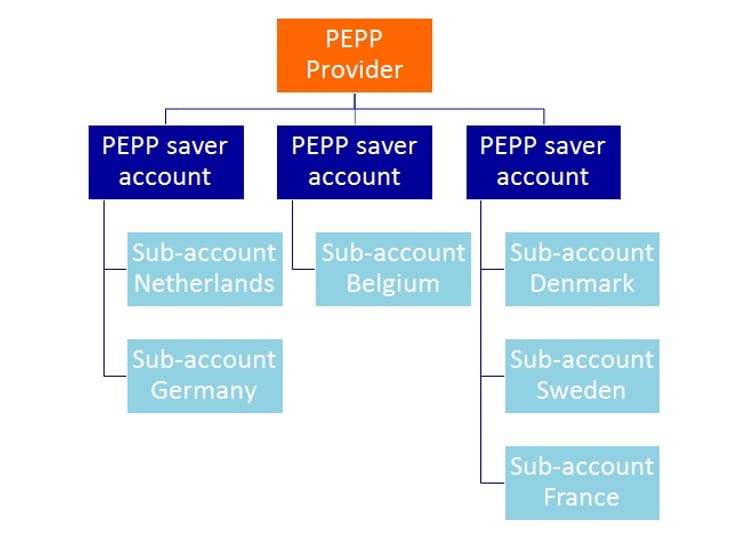

Due to the different tax regimes across member states, the PEPP saver will have a sub-account per country as shown in Figure 1. Within each country, the saver will have several (investment) options. Each PEPP provider has to offer national sub-accounts for at least two member states.

Once a saver retires he will receive a payment from each possible sub-account. For each sub-account, the member state will determine the possible start date of the pay out, the type of benefit payment (annuity, lump sum, fixed term) and amount of taxes that will be charged.

Figure 1: PEPP structure

What do we know about the investments?

The PEPP saver has to choose between a maximum of 6 investment options at the start of the contract and should have the possibility to modify that choice at least once every 5 years. The PEPP saver can also choose to switch PEPP provider all together.[2]

All providers should offer a Basic PEPP. The Basic PEPP should be a safe product representing the default option. All investment options should be designed with a guarantee or a risk-mitigation technique (like a lifecycle). This guarantee should at least cover the contributions which are due at the start of the pay-out phase. EIOPA will provide technical standards on the minimum criteria these risk-mitigation have to satisfy.

PEPP shall invest the assets in accordance with the prudent person rule and the use of derivatives is only allowed to reduce investment risks or facilitate an efficient portfolio composition.

PEPP providers are encouraged to allocate a significant part of their assets to sustainable investments with long term economic benefits, in particular to infrastructure and corporates. Furthermore, they are encouraged to consider ESG factors in investment decisions. PEPP providers are prevented from investing in specific countries with strategic deficiencies or specific tax havens (according to the EU).

[2] The PEPP provider is allowed to let the PEPP saver modify its investment option more frequently.

What about the costs?

The total costs of the Basic PEPP should be limited to 1% of accumulated capital. This maximum is still well above the current Dutch practice of investments costs of 30 to 40bps. This limitation does not apply to other investment options a PEPP offers.

Full transparency on costs and fees related to the investment in a PEPP should be guaranteed. In order to provide a level playing field for the different PEPPs and their other different products, the EIOPA will provide technical standards on how the costs and fees to be taken into account.[3]

[3] The costs and fees should be regularly revised in order to ensure adequacy. In order to prevent burdensome cost structures for PEPP savers, the Commission is empowered to adopt delegated acts which limit the costs and fees that can be charged.

What are the other obligations of the PEPP provider?

Information – PEPP providers and distributors should provide clear and easy to understand adequate information to possible PEPP savers and beneficiaries. Before concluding a PEPP contract, the PEPP saver should be given all necessary information to make an informed decision.

The providers should provide a Key Information Document(KID) on their website for each member state containing specific information on accrual and pay-out phase for that jurisdiction. The KID should be clearly distinguishable from marketing materials. The detail of the information included in the KID will be developed by EIOPA after consulting other European supervisory authorities (ESAs).

PEPP providers should also provide an annual benefit statement to the PEPP saver. This should be clear and comprehensive and should at least include information on benefit projections, contributions, possible pay-out dates, breakdown of costs, past performance and information on the investing policy relating to ESG factors.

Advice - PEPP providers or distributors are obliged to give the PEPP saver advice:

Similar individual pension products in the Dutch market do not require any advice and can be accessed using execution only. Current regulation for PEPP does not appear to offer this possibility which can make the PEPP relatively less appealing.

Transfer - If a PEPP saver moves to another member state and the provides does not offer a sub-account in that member state, the PEPP provider should make it possible to switch immediately and free of charge to another PEPP provider.

As mentioned before, all other forms of transfers can be done at least once in 5 years, and in this case, only the actual administrative and transaction costs can be charged up to a maximum of 0.5% of the accrued capital.

The PEPP saver has also the option to continue to contribute to the same sub-account where contributions were made before changing residence.

Who will offer a PEPP?

In our view, the answer to this question will highly depend on the technical standards, which are being worked out by EIOPA. We expect to the following parties to enter this new market:

Will the PEPP make a difference?

This is a hard question to answer at this stage. It depends on your reference point, i.e. country of residence and/or feature of the product.

One important condition for success is whether the product will get a tax friendly treatment. Without a tax incentive the product is unlikely to work, especially if it will have to compete with alternative pension products with a tax friendly treatment. Whether the PEPP will receive such a treatment will depend on the member state. These will likely only provide these incentives if the new product complies with similar available products. This will mean the PEPP products will differ greatly between countries.

There is a vast difference between the amount of accrued pension between the different EU countries and the availability of pension products. The PEPP can provide consumers access pension products in countries with less developed pension systems. A PEPP provider however only has to offer its product in two Member states. If for example all PEPP providers decide to target only western European countries, this would mean eastern European countries still would not have access to the PEPP. The PEPP therefore might have lost some of appeal due to a (likely) lack of a EU-wide coverage. It is to be seen whether it will actually enhance international labour mobility.

What about PEPP in the Netherlands?

But even under the assumption that all countries will provide tax incentives which resemble local products, we believe that in the PEPP will have a limited role in the Dutch pension market because of:

However, we do see some potential for PEPP in the Dutch market in the long run, because: