Research

The Basics of Electricity Price Formation

Europe is facing very high prices for both natural gas and electricity. In many European countries, the prices of both commodities are related, most of the times. However, electricity prices are not pegged to natural gas prices. This article explains how electricity prices are established.

Summary

Wholesale Electricity Prices

There Is No Such Thing as ‘The’ Electricity Price

First of all, it is good to bear in mind that there are multiple wholesale electricity markets and therefore also multiple electricity prices, which are set for contracts with different maturities (see Figure 1). As a rule, electricity suppliers buy part of the electricity they expect to supply at a given moment in time on the futures markets, or through bilateral contracts[1], and the remainder on the day-ahead and intraday markets. This article refers to the day-ahead market and the intraday market as the ‘spot market’.

[1] Power Purchase Agreements (PPAs) are examples of bilateral contracts. More information on PPAs can be found here.

Figure 1: A simplified overview of the wholesale electricity markets

The Relationship Between the Price of Natural Gas and the Price of Electricity

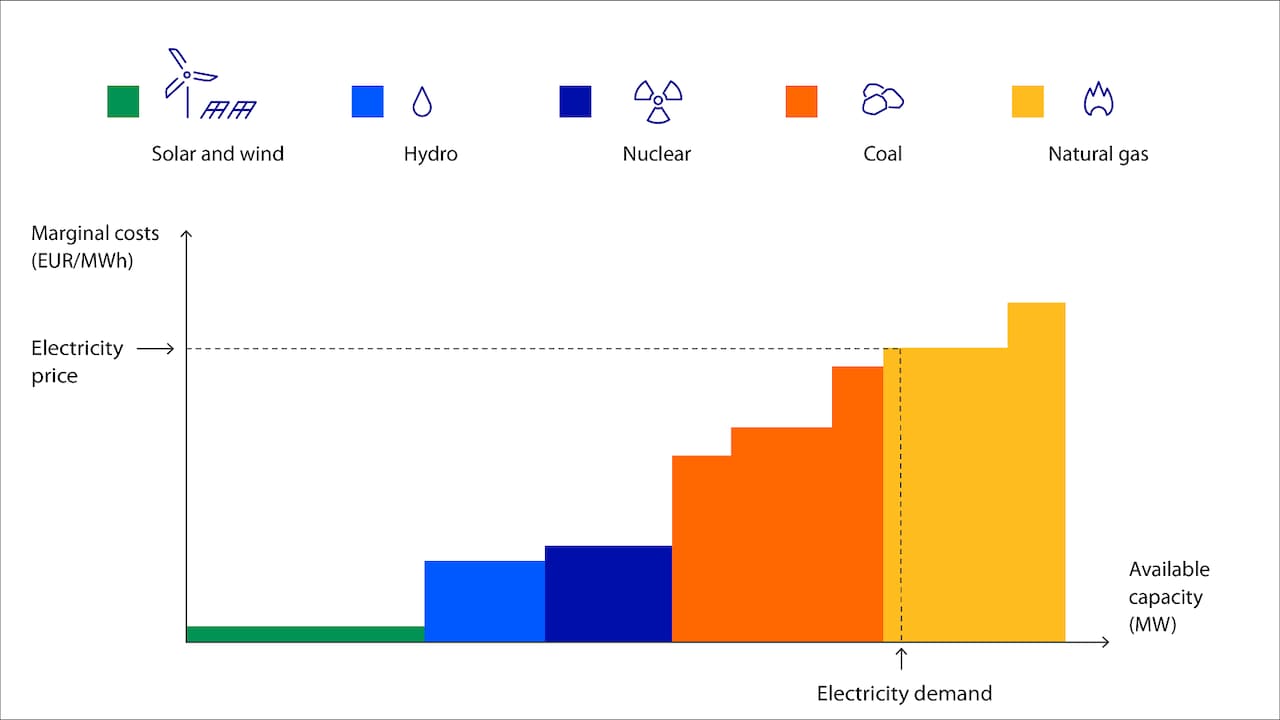

Looking at the spot market, the match between supply and demand based on the marginal costs of the most expensive power plant in operation is what determines the electricity prices. This mechanism is known as a merit order (see Figure 2). Solar and wind farms can produce electricity at very low marginal costs, as they neither require fuel to produce electricity, nor carbon emissions allowances. At the other end of the spectrum, coal and natural gas-fired power plants have to pay for fuel and buy carbon allowances.[2] The exact position of these plants in the merit order always depends on the current prices of coal, natural gas, and carbon allowances, and on the efficiency of the plants.[3]

[2] More information on the functioning of the EU’s carbon market works can be found here.

[3] Generally, natural gas-fired power plants are more efficient than coal-fired power plants. Modern natural gas-fired power plants can reach an efficiency of 60%, while modern coal-fired power plants reach an efficiency of 46%. This means that coal-fired power plants require more fuel and more carbon allowances than natural gas-fired power plants in order to produce the same amount of electricity.

Figure 2: A simplified generic example of a merit order

At present in Europe it is more expensive to produce electricity from natural gas than from coal.[4] This means that it is now the natural gas-fired power plants that set electricity prices on the spot markets when the demand for electricity is high enough. This situation is common in many European markets. Therefore, there is a certain degree of correlation between electricity prices and natural gas prices in markets with a high share of gas-fired power plants in their electricity generation mix. However, the prices for these two commodities are not formally pegged. There are various instances where other types of power generators determine electricity prices. For example, even countries that still have a relatively low share of renewable power generation sources, such as the Netherlands, already benefit from very low or even negative electricity prices at times when demand is low and solar and wind farms can produce a lot of electricity. Similarly, in the northern parts of Norway, for example, hydropower plants are setting electricity spot prices most of the time. Another example comes from Poland, where coal-fired power plants often determine electricity prices.

[4] Electricity production by coal-fired power plants is about twice as carbon-intensive as electricity production by natural gas-fired power plants. However, the price of natural gas in Europe is currently so high (compared to the price of coal) that it outweighs the higher cost of carbon allowances for coal-fired power plants.

Retail Market Electricity Prices

Retail consumers do not pay wholesale prices for electricity. In general, electricity suppliers add a risk and profit margin to the wholesale price. In addition, consumers pay taxes and other charges.[5] Although wholesale electricity prices vary from hour to hour or even from quarter to quarter, retail consumers typically pay a fixed amount per kWh for the duration of their contract or at least per month. Wholesale prices represent only a fraction of the total retail price. In the Netherlands, for instance, the average hourly day-ahead electricity price was around EUR .22/ kWh in the first six months of 2022, while retail consumers paid about EUR .61/kWh, depending of course on the type of contract they had.

[5] For example, retail consumers also pay for the transmission and distribution of electricity. In some European countries retail consumers pay a price per kWh, in others a fixed annual price depending on the supply size of their electricity connection. In both cases, these costs are not related to the wholesale electricity prices.

Can Electricity Prices Be Decoupled From Natural Gas Prices?

Although electricity prices are not pegged to natural gas prices, in many European countries there is definitely a relation between the prices of these two commodities most of the time. The only direct way to decouple the social costs of electricity production from natural gas is to completely stop using natural gas to produce electricity. Unfortunately, this is not an option in the short term if we want to keep the lights on.

The European Union could choose to change the electricity market model. There have been rumors of an overhaul plan for some time, and on August 30, Ursula von der Leyen announced that the European Commission (EC) is indeed preparing to ‘end the link between gas and electricity prices.’ What this plan will entail remains to be seen. The EC could, for example, choose to design the wholesale markets in such a way that electricity prices are no longer determined by the marginal cost of the most expensive power plant in operation, or to introduce a price cap on either electricity or gas prices. Normally, changing the market model takes years as the best alternative must be developed, legislation must be changed, and market players need time to adapt to the new situation. Hasty changes in market models could lead to problems, for instance with regard to the security of supply. Also, there is no consensus yet on what the best alternative to the current market model is and whether there is a better alternative at all. But given the current energy crisis, Ursula von der Leyen has suggested a fast-tracked approach, in line with other recent regulatory changes related to energy supply and pricing.

An alternative to decoupling wholesale electricity prices from natural gas prices is to decouple retail electricity prices from wholesale prices, for example by capping them. Obviously, this would most likely mean that in this case energy suppliers would need financial support to overcome the gap between the costs they face and the prices they can charge retail consumers. Otherwise, they could go bankrupt.

At the end of the day, the costs of electricity production will need to be covered by someone. This also means that as long as natural gas remains a significant source of electricity production in Europe, and natural gas prices stay high, average electricity production costs will also remain high.