Research

Second wave of Covid-19 impacts economic recovery in India

The number of new infections in India will bottom out in May. Economic pain will come through decreased private consumption after mobility levels dropped. RBI continues its accommodative policy but relatively high debt levels limit the government’s flexibility to support the economy.

Summary

Dramatic surge in cases puts healthcare sector under pressure

India is arguably facing world’s most severe health crisis since the beginning of the Covid-19 pandemic. The number of new cases is breaking historic global records each day (Figure 1). While numbers are stunningly high, they probably represent only a part of the total infections since testing facilities are overwhelmed. The enormous flood of newly infected citizens is putting the healthcare sector under severe pressure, with shortages in hospital beds and oxygen cylinders. These shortages further exacerbate the crisis because people of all ages have no access to much-needed healthcare. The result is not only higher mortality rates but also a much higher risk of a fatal Covid-19 infection among people who would likely otherwise survive. Governments of other countries have sent medical supplies in order to help India. Nonetheless, this does not solve the logistical challenges that are currently part of the problem. At this point it is all about crisis management, and the healthcare situation is far from stable. But can we expect to see a decline in new infections anytime soon?

Figure 1: Covid-19 infections rise steeply

How will the spread progress?

As economists we tend to refrain from projecting the future spread of the virus. However, we try to comprehend the available data to get a grip on where we are “on the infection curve”. This helps us to try and predict economic performance going forward.

Since India’s medical sector is close to collapse, data might be less reliable than in non-crisis times, especially with regard to non-urban regions. In order to gage the current penetration of Covid-19 in India we use Google search data to investigate the relative interest in Covid-19 related searches. This might be a good proxy because many Indian people have access to Google via their smartphone or computer and this data shows a strong correlation with the actual number of infections.[1] Figure 2 shows the relative interest in Google search data for some obvious Covid-19 related symptoms. This high frequency data suggests that the peak of infections is leveling off. This, at least, provides some light in dark and uncertain times. However, we should keep in mind that it could also be explained by an increase in knowledge among the population as they get used to high penetration levels and gather additional knowledge.

[1] Correlation matrix in appendix.

Figure 2: Interest in Covid-19 related searches levels off

Unfortunately, even in a scenario where cases do indeed come down significantly in the coming weeks, it will take time for the overheated healthcare sector to cool down and for queues for hospital beds and Covid-19 tests to disappear. But at least the lower number of daily infections will provide some relief from the current crisis situation in the healthcare sector. In time, this will result in fewer lockdown measures and higher mobility among the population and help India get back onto the path of economic recovery.

Vaccinations provide no relief in the short term

Vaccinations are another way to ease the pressures on the healthcare sector from the rise in Covid-19 cases. In our last report we noted that Indians were reluctant to get their vaccine in February, and not all capacity was utilized. But demand for vaccinations has boomed in recent weeks, not only due to the spike in cases but also because of the government’s decision to lower the age of eligibility to 18+ from 1 May. For the coming period we can assume a lack of supply rather a lack of demand. India has secured vaccine doses for 85% of the population and even though it has stopped exporting it still faces capacity constraints which are currently limiting production to 90 million jabs a month in May.

In order to measure the potential vaccination rate going forward we show two scenarios in Figure 3. In the first scenario we project the number of fully vaccinated people (assuming that each individual needs two shots) at the current pace of about 2 million jabs a day. Continuing at this pace means that, at the end of the year, approximately 22.5% of Indian people will be fully vaccinated (600 million jabs). This falls far short of the mark associated with ‘herd immunity’.

Figure 3: Herd immunity in 2021 is a long shot

For the second scenario we use a higher daily vaccination rate. In mid-April India was briefly able to provide around 3.5 million jabs a day. Assuming that this number of vaccinations can be sustained from June onwards, this still means that only approximately 35% of the population will be fully inoculated by year-end, which is only half of the rate a country needs for herd immunity.[2]

In short, we can conclude that the number of cases seems to have reached its ceiling, but pressure on the healthcare sector will continue for weeks or even months. Since a spread of the virus has an effect on the economy, we will now assess how this impacts imposed lockdowns, the mobility behavior of the Indian population and how this translates into economic performance.

[2] Scientist early estimates were that at least 60-70% of the population would need to be immune through vaccination or previous infection to reach herd immunity. However, latest research suggest that reaching a threshold for herd immunity might be less straightforward than initially thought due to a number of complexities.

Impact on the economy

The economic recovery in the first quarter appears to have been strong. But it came at a high cost, as the loose lockdown policy by the government and opportunistic behavior on the part of the population probably caused the second spike in cases. As such, the economy will most likely take a step back in the second quarter. However, because we expect cases to come down from the second half of May onwards, the economic pain will likely be concentrated mostly in Q2.

Impact on economy through consumption

More restrictions and a higher penetration of the virus leads to lower mobility among the population. This limited movement will translate into lower private consumption. We saw this happen across the globe last year. This is important because private consumption represents more than half of India’s economic performance. Consumers and businesses are probably better able to deal with movement limitations due to the experience of the last year. Nonetheless, particularly service goods will suffer as people limit their movements or are simply forbidden to use these services to avoid getting infected.

The stringency of lockdown measures is relatively low when compared to the first wave (Figure 4). However, when we look at the high frequency data on mobility (Figure 5) we notice that the Indian population has taken matters into their own hands anyway, as movements by people have dramatically decreased. This is a clear indication for the fear of getting infected among Indians. Currently people are limiting their movement as much as in Q3 last year. But clearly the relation between lockdown measures and movement is weaker than in the second wave.

One of the possible explanations is that restrictions are now being imposed on the state level. One advantage is that they can be tailored toward the local situation, as opposed to last year when the Indian government imposed strict lockdowns across all states. Currently in states with lower infection rates lockdowns can be less strict than in other states, which leads to a lower “overall” stringency index (as the stringency index as presented here is an aggregate for India as a whole). But as cases mount there is increasing pressure on Prime Minister Modi to impose nationwide lockdowns.

Figure 4: Lockdown stringency below historic highs

Figure 5: Mobility fell off a cliff in April

At the beginning of the first wave these strict lockdowns also had a very negative effect on industrial activity in India. How is industrial production holding up during this second wave?

Impact on the manufacturing sector

To prevent an economic collapse similar to last year’s most of the lockdown measures are now more targeted. For example, the state of Maharashtra allows continued production from companies that produce essential goods and services, have in-house accommodations or need to fulfil export obligations. This means that people working in these factories continue to receive income, and essential goods and services are still supplied locally and internationally. Economic data confirms that the impact on the manufacturing industry remains small (Figure 6).

Figure 6: Manufacturing holding up well, for now..

Although we need to take into account the fact that the most recent survey was conducted in mid-April, when the number of infections was still lower than in May.

If India is unable to slow the number of infections going forward, additional lockdown measures might be required. This would negatively impact the supply side of the economy.

The picture of the impact of the second wave, the lockdowns imposed and the potential effect on consumer behavior and industrial output is somewhat gloomy. Now let’s focus on what the central government can or cannot do to combat these negative economic effects.

Countering economic consequences

In a recent study we found that government stimulus globally probably prevented economic contractions of much greater magnitude in many G20 countries. As a reaction to the first wave India also announced a fiscal stimulus package, which probably prevented a larger economic contraction. The size of this fiscal stimulus package (in which the government uses a wide range of stimulus measures like direct support, tax deferrals and guarantees) is approximately 3.2% of GDP. A more in-depth analysis was presented in an earlier publication. In addition, the government expanded the fiscal budget for FY 2021, including a whopping 137% increase in healthcare expenditure, which also includes INR 350 billion reserved for vaccines.

New wave, new fiscal stimulus?

The new wave of infections might require additional government stimulus to help prevent large economic contractions and/or negative economic spillovers into the rest of 2021. But taking into account the additional stimulus to combat the first wave of the pandemic, the question is: how much fiscal headroom does the government have left to help sustain the economic momentum?

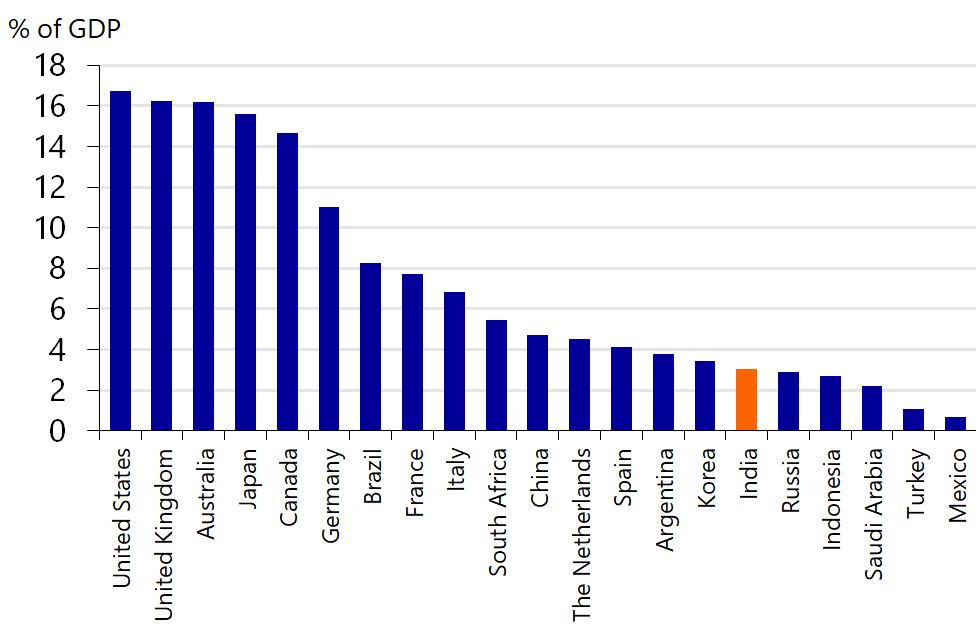

Figure 7: Size of Covid-19 fiscal stimulus package compared to G20

Looking at the size of the initial fiscal stimulus (Figure 7) we observe that the initial package is small compared to developed G20 economies. However, as we have shown earlier, emerging markets are more constrained in their additional fiscal stimulus than developed economies. Indeed, India’s stimulus is comparable to some other G20 emerging markets like Indonesia.

But consideration of some fundamental factors like government debt and interest cost as % of government revenue is even more important than making peer comparisons (Figures 8 & 9). These indicators give a sense of how much additional debt can be absorbed. For India, both indicators suggest that the fiscal flexibility might be limited.

Figure 8: Significant increase in government debt

Figure 9: Interest costs as % of revenue is highest among peers

India’s government debt increased significantly in 2020 and is the highest among southeast Asian peers (Figure 8). Additionally, interest rate costs on debt relative to government revenues is high, with almost one-third of government revenue needed to service debt (Figure 9). This is much higher than India’s regional peers. Although the government aims to reduce this by increasing the tax base and privatizing government assets, it might be unrealistic to expect this additional income in the short term.

If the Indian government increases spending in the form of a second Covid-19 stimulus package it will probably prevent a loss in economic output in the short term, but this simultaneously puts more pressure on the sustainability of debt in the longer term, essentially mortgaging their future. India’s policy makers find themselves between a rock and a hard place when it comes to decisions on additional fiscal stimulus.

At the time of writing there are no new government announcements for additional fiscal stimulus to support the economy during the second wave of the pandemic, although these might be announced in the near future. Nevertheless, the RBI already announced additional measures in an unscheduled speech on 5 May. How does the central bank aim to help India regain economic momentum amid the surge in new infections?

Accommodative RBI policy

During his speech on 5 May central bank Governor Das announced an array of monetary policies to combat the effects of the second wave of the pandemic. Much of the additional stimulus is focused on increasing liquidity in the system and safeguarding the flow of credit toward important parts of the economy. The central bank aims to: 1) enable banks to provide lending to entities related to the dire healthcare situation[3], 2) provide additional liquidity to small banks and finance providers, and 3) incentivize credit flow toward MSME entrepreneurs.

[3] These are for example: vaccine producers, hospitals and logistic companies

Figure 10: Government bond yields close to 6%

In addition, the Governor doubled down on his commitment to keep government bond yields stable by announcing a second round of purchases of government securities in May.

The RBI had already announced a government bond buying program in April, which it calls the G-SAP 1.0, in which:

“RBI will commit upfront to a specific amount of open market purchases of government securities with a view to enabling a stable and orderly evolution of the yield curve amidst comfortable liquidity conditions.”

Effectively this means they are stabilizing 10yr government bond yields around 6%. The purpose is to keep government debt affordable as yields have increased since the FY22 budget was announced (Figure 10). Such monetary policy eases pressure on the central government and increases their fiscal flexibility going forward.

However, in our view a word of caution from an economic perspective is warranted. This form of “yield curve control” might be a short-term cure to the limited fiscal flexibility of the government, but it could have a negative backlash further down the road. We already pointed out the risk of policies like MMT, in an earlier report. In short, such policies contain serious medium-term risks as they could potentially have a negative impact on inflation and, hence, on the currency. This, in turn, has consequences for the economic performance and sustainability of India’s government debt. In the long-term this may actually do India more harm than good.

Appendix

Table 1: Correlation matrix