Research

Global economic outlook: Risk of a global recession has risen

Our growth forecasts for the global economy have been revised downwards. The risk of a global recession has risen. In addition, a continued period of low interest rates harbours risks in the long run.

Summary

The risk of a global recession has risen. Some governments and central banks are trying to prevent such a scenario through more stimulus. This may help to delay or even avoid a recession, but there are also various risks that could cause lower growth than we currently expect. In that case, there is a real possibility that the world economy will enter a recession anyway. The escalating trade war between the United States and China is the main example of such a risk. Lastly, the continuing low level of interest rates is a significant downside risk for developed and emerging economies in the longer term.

Is a global recession on the cards?

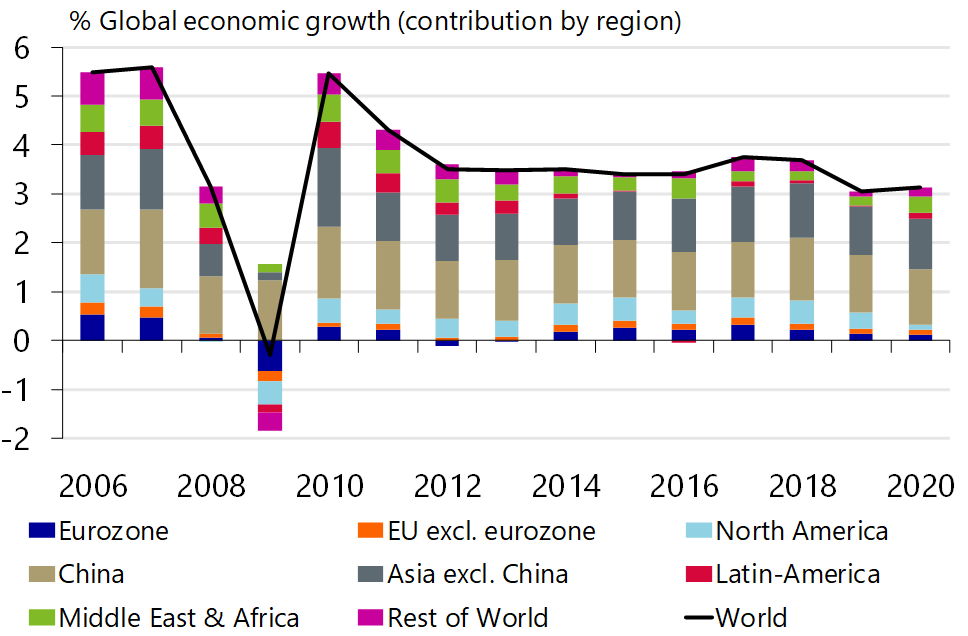

In our last Economic Quarterly Report we were still forecasting real GDP growth of 3.3 percent in 2019 and 2020. We have now adjusted our forecast for global economic growth downward to 3.1 percent in both years. According to the unofficial definition of the IMF, global GDP growth of less than 3 percent constitutes a global recession (WSJ, 2009). The last time this happened was in 2009. Our new estimate puts the global economy very close to this level. This global economic slowdown is being felt in many regions (table 1, figure 1).

One of the main reasons for the downward adjustment to our growth forecast lies in the fact that most economies are at the end of their economic growth cycles. The peak in economic growth has thus been reached in most countries, or is behind us. The worsening outlook for exports is also a key factor. While this is being offset by fiscal or monetary stimulus in many economies, we do not expect the stimulus to be sufficient to outweigh the worsening trade outlook.

Table 1: Economic prospects for major economies

Figure 1: Global growth approaching the recession level of 3%

Figure 2: Growth in world trade slows further

According to the latest CPB estimate, the volume of global trade contracted by 1.4 percent in June compared to May, with the total quarterly contraction amounting to 0.7 percent. The contraction seen in the first quarter was 0.3 percent, due once again to a decline across many countries (figure 2). Another reason for our gloomier trade outlook is the escalating trade war between the US and China. Although the economic damage from further escalation will be felt mainly in these two countries, countries that are not directly involved in the conflict are also negatively affected.

The escalating trade war is depressing economic growth

Since the beginning of the trade war between the US and China in 2018, we have taken the view that the conflict was likely to be lengthy, as both countries are miles apart on structural issues (see also here and here). Our study in November 2018 listed a number of scenarios with respect to the trade war (see Erken, Giesbergen and De Vreede, 2018). The underlying question was how the conflict might escalate, and how quickly. After the initial negotiations stalled in May, it was agreed after the G20 summit in Japan at the end of June 2019 that there would be further negotiation regarding a deal in September. What was initially looking to be a relatively quiet summer, was disrupted in August when the US announced a new raft of tariff increases that would take effect on September 1st. The main reason for the initial announcement of the tariff increases was dissatisfaction with the way China was complying with agreements made at the G20 (see Giesbergen et al., 2019).

Both countries have now imposed higher import duties on a large proportion of each other’s imports and several further tariff increases are planned (figure 3). China also responded to the new American import duties by allowing the renminbi to depreciate beyond the level of 7 per US dollar. The US then decided to label China a currency manipulator, having refrained from doing so in May 2019. Currently, a dollar buys even slightly more than 7 renminbi (figure 3). The depreciation of the Chinese currency since the start of the trade war is a key assumption in our scenarios and we expect the currency to decline further against the US dollar over time.

Figure 3: Timeline for the US-China trade war

The escalation of the trade war has negative economic effects on several fronts. As we mentioned above, the two countries concerned are the most affected. But the effects will be asymmetrical, since we believe China will suffer more economic harm than the US. This is mostly due to China’s relatively high dependence on technology and inputs from the US. In addition, the uncertainty caused by the trade war will accelerate a relocation of foreign production out of China to other countries in the region, further slowing economic growth (see Hayat, 2019). Other countries are feeling the pain indirectly through the decline in world trade (figure 2). As our previous studies have shown, the pain is being felt mainly in the sectors that are most integrated in global value chains between these two countries, as is the case for the Netherlands (see Erken, Giesbergen and Nauta, 2019).

Figure 4: Chinese currency breaches the level of 7 per US dollar

What do we expect going forward?

We see the conflict continuing in fits and starts in the coming period. In other words, one step forward will be followed by two steps back. It is important to stress that any deal between the two countries involves more than just trade. Structural issues such as the breach of intellectual property rights, the compulsory transfer of technology, the huge subsidies to Chinese state owned entities and access to markets are key items for the US that will have to form part of an all-encompassing deal. Should there eventually be an agreement, this will also involve an enforcement mechanism, something China clearly does not support. We therefore think the most positive outcome possible is a ‘mini-deal’. If this happens, China would for instance import more agricultural products from the US in exchange for reducing the sanctions against Huawei and/or postponing announced tariff increases. But the tensions between the two countries will continue to simmer below the surface for a long time to come.

Continued low interest rates could lead to risks in the future

Long term interest rates are declining in developed countries around the world, especially in the Eurozone and the US (figure 5).[1] The monetary policy of central banks is often cited as the main culprit for this decline, but it is only part of the story. There are also structural factors at play. These factors mean that interest rates could continue to stay low for a long time yet.

Low interest rates make it cheaper to borrow money and can boost economic growth. Consumers for instance can get a mortgage on relatively favorable conditions and businesses and governments can raise capital at a lower cost. According to estimates by the European Central Bank (ECB), ‘extreme’ monetary policy in recent years has raised GDP growth by nearly 1 percent in 2018 and inflation by nearly half a percentage point. However, a lengthy period of low interest rates also involves risks, as the Dutch central bank and the Bank for International Settlements (BIS) have already warned. These risks manifest through various channels, as we briefly explain below.

Monetary policy

The monetary policy rate in the Eurozone has been negative since 2014, and in Japan since 2016. This rate is higher in the US, namely 2.25 percent. However, it was also significantly higher just before the great financial crisis in 2008 (figure 6). Together, this group of countries accounts for nearly half of global GDP. If an economic crisis were to materialize in the next two years, it is not clear how far the Bank of Japan and the ECB could go with negative interest rates before savers will choose to withdraw large volumes of cash (cash is not subject to negative rates, although it does entail storage and security costs). But the US Federal Reserve (the Fed) also has less ammunition than in the past. Central banks will thus have to turn to less conventional measures for monetary stimulus. This has been happening on a large scale recently, for instance with the financial assets purchasing program known as quantitative easing. Quantitative easing has led to a situation in which the central banks of the United States, the eurozone and Japan collectively have almost 15,000 billion US dollar worth of bonds and other financial assets on their balance sheets. This kind of unconventional policy however may have negative side-effects, as we discuss below.

[1] With long term interest rate, we mean the interest rate paid on a loan with a long maturity, for example 10 years.

Figure 5: Long term rates are significantly lower than 10 years ago

Figure 6: And policy interest rates of major central banks are too

Financial institutions

Pension funds and insurers suffer from lower interest rates, because their liabilities are more sensitive to interest-rate movements than their assets. This means that if interest rates fall, the value of their future liabilities increases faster than the value of their assets. The ratio between the value of a pension fund’s assets and its liabilities is known as the coverage ratio. So when interest rates go down, the coverage ratios of pension funds go down as well. The Netherlands has relatively large pension funds and Dutch legislation requires pension funds to adjust their benefits and contributions if their coverage ratios are too low for too long. The pension funds in other European countries are not as large and the rules in the US and the UK are less strict, but the same problems apply in these countries as well to a lesser extent.

If lower interest rates are accompanied by a flatter yield curve, this can affect the profits of banks.[2] The spread between long and short term interest rates is a major component of banks’ earnings. A lengthy period of reduced earnings could erode the financial buffers of banks. This could have implications for financial stability in the long run since lower buffers mean that banks are less resilient to financial setbacks.

Housing markets and financial assets

A lengthy period of low interest rates can also mean that the value of assets such as stocks, bonds and real estate rises far above their fundamental value. The so called ‘search for yield’ can increase the demand for stocks, high-yield bonds and real estate to such an extent that asset prices become excessive[3]. For example, some people believe that an overly accommodative monetary policy by the Fed led to an overvalued US housing market, which in turn was partly responsible for the 2008 financial crisis.

Productivity

Low interest rates can negatively affect the growth potential of countries if it allows low productivity companies to continue to exist, as shown among others by a study of the OECD. These companies would not be able to survive in a higher interest rate environment, as they would not be able to service their debt. Because a large part of their earnings are used for interest payments. If credit providers are prepared to continue to grant such loans, a low interest-rate environment allows these so-called ‘zombie’ companies to continue to exist. This means that labor and capital are not used optimally. Because it would have been better to allocate this labor and capital to innovative and productive companies.

[2] A yield curve is flat when there is no difference between the short-term interest rate (with a maturity of less than 1 year) and a long term interest rate (with a maturity of, for example, 10 years). We speak of a flatter yield curve when the difference between the long-term and short-term interest rate becomes smaller.

[3] The price of a financial asset reflects an expectation of future return. If this price rises sharply, it could mean that the underlying expectation of return is unrealistic. When this happens on a large scale, it is called a financial bubble.